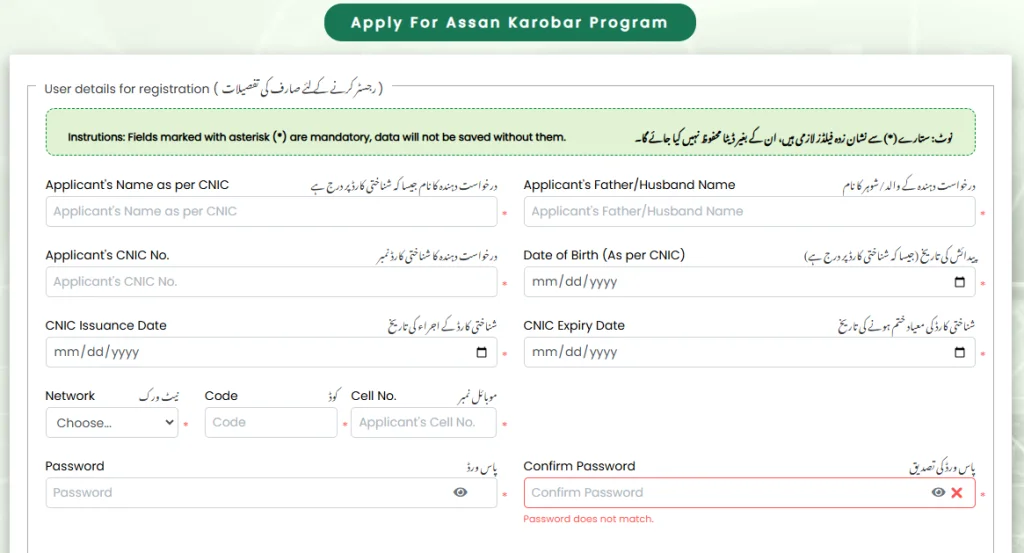

The Asaan Karobar Card (AKC) apply online has been started via akc.punjab.gov.pk. Please visit the link below to register/login to your account. You can submit your applications digitally via the PITB portal.

This scheme empowers small businesses in Punjab by providing interest-free loans up to PKR 1 million through a digital SME card, ensuring transparent and structured fund utilization via digital channels.

پنجاب حکومت نے وزیراعلیٰ پنجاب آسان کاروبار کارڈ کا آغاز کیا ہے، جو چھوٹے کاروباری مالکان اور کاروباری افراد کی مدد کے لیے ایک انقلابی اقدام ہے۔ یہ پروگرام چھوٹے اور درمیانے درجے کے کاروباری اداروں (ایس ایم ایز) کو ترقی اور پھلنے پھولنے میں مدد کے لیے 10 لاکھ روپے تک کے بغیر سود قرضے فراہم کرنے کے لیے ڈیزائن کیا گیا ہے۔ موبائل ایپس اور پی او ایس سسٹمز جیسے ڈیجیٹل ٹولز کا استعمال کرتے ہوئے، آسان کاروبار کارڈ شفافیت اور سہولت کو یقینی بناتا ہے، جس سے کاروباری افراد کے لیے اپنے کاروبار کا انتظام اور برقرار رکھنا پہلے سے کہیں زیادہ آسان ہو جاتا ہے۔

یہ اقدام پنجاب بھر میں معاشی ترقی کو فروغ دینے اور چھوٹے کاروباروں کو بااختیار بنانے کی جانب ایک قدم ہے۔ یہ مضمون سرکاری پورٹل

akc.punjab.gov.pk

کے ذریعے آسان کاروبار کارڈ پروگرام کے لیے رجسٹر اور لاگ ان کرنے میں آپ کی مدد کے لیے ایک مرحلہ وار گائیڈ فراہم کرتا ہے۔

AKC Punjab gov pk Login

Asaan Karobar Card Registration / Login

Loan Details:

- Maximum Loan: PKR 1 million

- Loan Term: 3 years

- Credit Type: 12-month revolving credit

- Repayment: 24 equal monthly installments (starting after the first year)

- Grace Period: 3 months from card issuance

- Interest Rate: 0%

Eligibility Requirements:

Applicants must meet the following criteria to be eligible:

- Be a Small Entrepreneur actively operating or planning to operate a business within Punjab.

- Be a Pakistani National aged between 21 and 57 years, residing in Punjab.

- Possess a valid CNIC and a mobile number registered under their name.

- Demonstrate that their business, whether existing or prospective, is located within the province of Punjab.

- Pass a credit and psychometric assessment.

- Submit only one application per individual and business.

- Maintain a clean credit history with no overdue loan obligations.

Steps to Apply:

- Online Application: Submit your application digitally through the Punjab Information Technology Board (PITB) portal.

- Processing Fee: Pay the non-refundable processing fee of PKR 500.

- Digital Verification: Authorized agencies will digitally verify your CNIC, creditworthiness, and business premises.

Loan Usage and Repayment:

- Initial Limit:

- 50% of the approved limit is available for use within the first 6 months.

- Grace Period and Repayment:

- A 3-month grace period applies from card issuance.

- After 3 months, monthly installments begin, with a minimum payment of 5% of the outstanding principal.

- Second Limit Release:

- The remaining 50% is released upon satisfactory usage, consistent repayments, and registration with the Punjab Revenue Authority (PRA) and Federal Board of Revenue (FBR).

- Restricted Usage:

- Funds are strictly for business purposes. Personal or non-essential transactions are blocked.

- Final Repayment:

- The remaining loan balance after the first year is repaid in 24 equal monthly installments (EMIs).

Charges and Fees:

- Annual Card Fee:

- PKR 25,000 + Federal Excise Duty (FED), deducted from the approved limit.

- Included Charges:

- Card issuance, Life assurance, and delivery charges are covered by the scheme.

- Late Payment Charges:

- Late payment fees will be applied according to the bank’s policy/schedule of charges.

Security and Verification:

- Security:

- Personal guarantee, digitally signed by the borrower.

- Life assurance is included.

- Verification:

- The Urban Unit conducts physical verification of business premises within 6 months of loan approval and annually thereafter.

Key Conditions:

- Business Usage:

- Funds are restricted to core business activities.

- Registration:

- PRA/FBR registration is mandatory within 6 months of card issuance.

- Application Limit:

- One application per individual/business.

Additional Support:

- Feasibility Studies:

- Available on the Punjab Small Industries Corporation (PSIC) and Bank of Punjab (BOP) websites for startups and new businesses.